Dive into our latest blog for a better understanding of the ever-shifting market sentiment in Ballast Advisor’s third-quarter update. Bullish optimism may be fading, but we’re here to equip you with the knowledge and strategies you need to conquer the challenges ahead. Uncover the insights that will empower you to navigate this changing landscape with confidence.

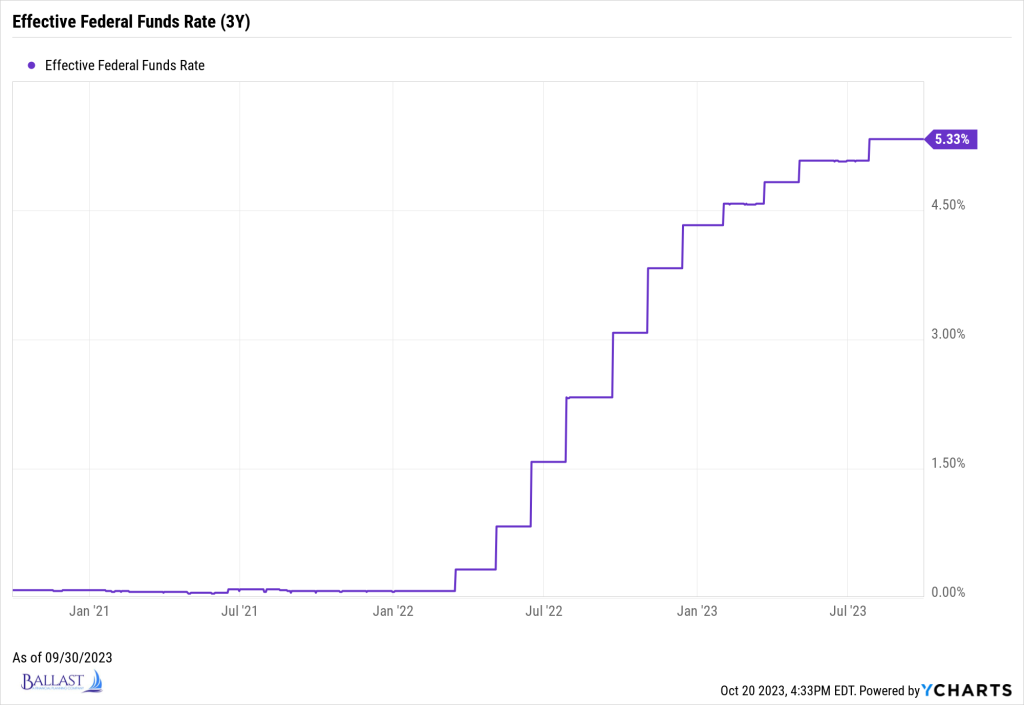

The third quarter of the year has been marked by a fading bullish sentiment in the markets, as the initial optimism that drove stocks higher has given way to a more cautious outlook. Many investors had hoped for a pivot by the Federal Reserve towards lower interest rates, but these expectations have proven to be misplaced. Instead, the belief now is that higher rates will persist for a longer period.

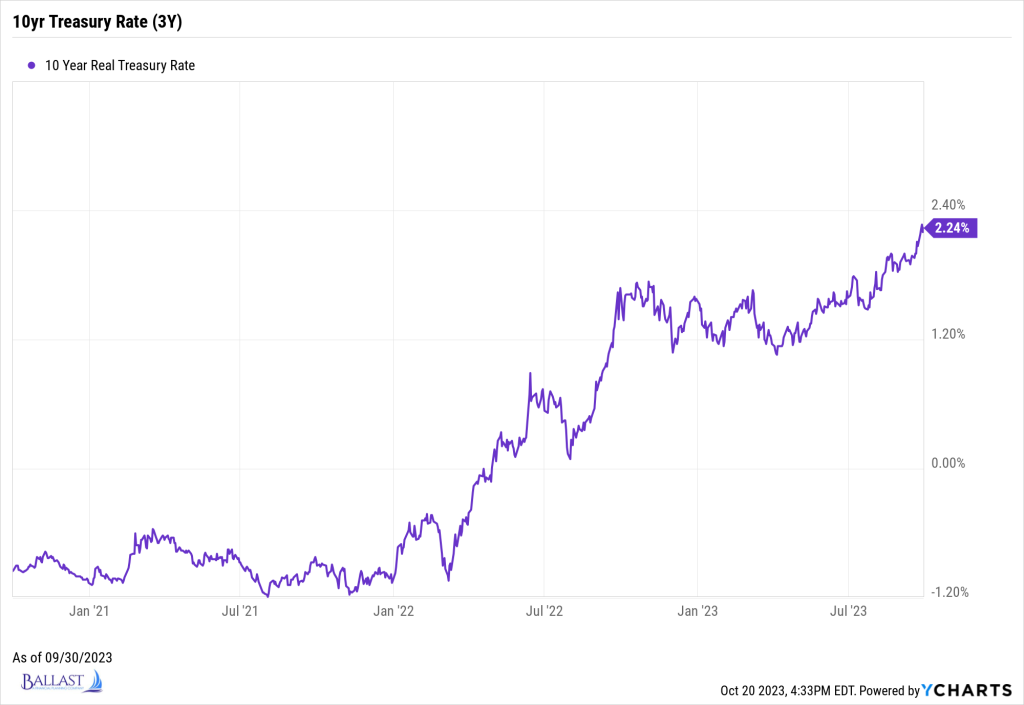

One of the notable consequences of this shift in sentiment is the performance of bonds. With the prospect of higher rates ahead, bonds have faced significant headwinds, and they are now flirting with the possibility of a third down year in a row. The fixed income market, which has traditionally been viewed as a safe haven for investors, has become less attractive in the face of rising rates.

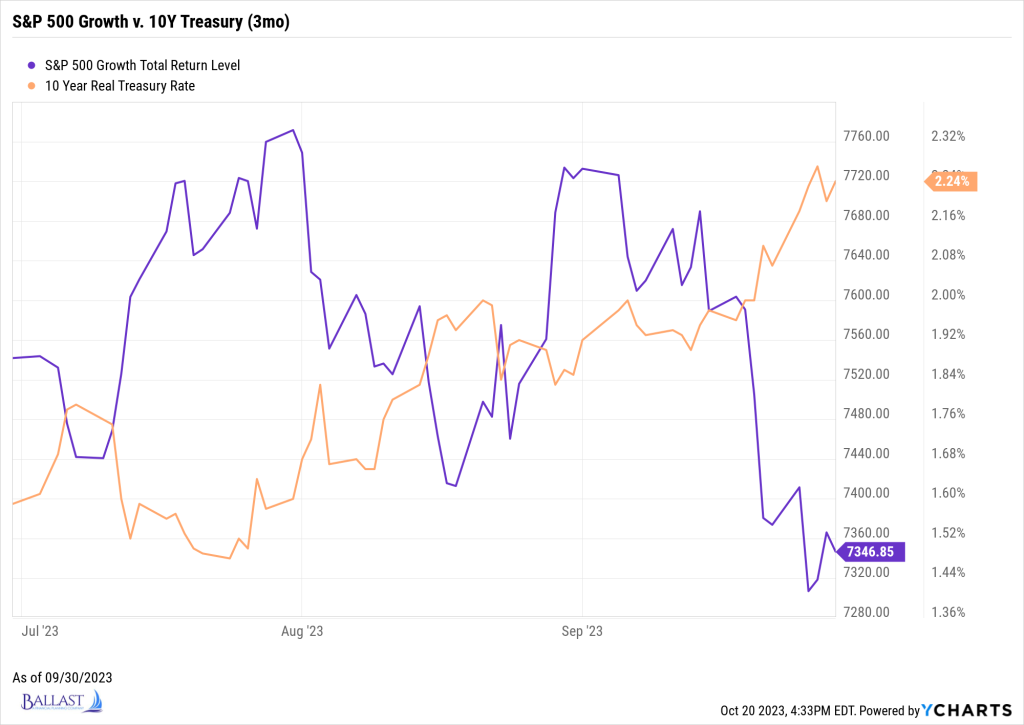

Another sector that has been impacted by the changing interest rate environment is growth stocks. These stocks, which had experienced a strong rally in previous quarters, have lost their steam as rate cuts appear to be out of the question. Growth stocks, often valued based on their potential future earnings, are particularly sensitive to changes in interest rates. As the cost of borrowing increases, the outlook for these high-growth companies becomes less favorable, leading to a decline in their stock prices.

Overall, the prevailing sentiment in the markets has shifted from optimism to caution in the third quarter. Investors who had anticipated a more accommodative stance from the Federal Reserve and continued support for growth stocks have had to reassess their strategies. The prospect of higher rates for a longer period has introduced a new set of challenges and uncertainties, prompting investors to reevaluate their portfolios and adjust their expectations accordingly.

Ballast Advisors remains committed to guiding you through future market and economic uncertainty. It is important to note that market conditions are constantly evolving, and the future trajectory of interest rates and market sentiment may change. Investors should exercise caution and seek professional advice when making investment decisions, taking into account your risk tolerance and long-term investment goals. We appreciate your continued partnership.

Disclosures: The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented is derived from sources Ballast Advisors consider to be reliable, but the accuracy and completeness cannot be guaranteed. Past performance is not indicative of future results. Nothing contained herein is an offer to purchase or sell any product. This material is for informational purposes only and should not be considered investment advice. Ballast Advisors reserve the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request. BAL-23-80