The IRS recently released the 2024 contribution limits for health savings accounts (HSAs), as well as the 2024 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs).

What is an HSA?

An HSA is a tax-advantaged account that enables you to save money to cover health-care and medical costs that your insurance doesn’t pay. The funds contributed are made with pre-tax dollars if you contribute via payroll deduction or are tax deductible if you make them yourself using after-tax dollars. (HSA contributions and earnings may or may not be subject to state taxes.) Withdrawals used to pay qualified medical expenses are free from federal income tax. You can establish and contribute to an HSA only if you are enrolled in an HDHP, which offers “catastrophic” health coverage and pays benefits only after you’ve satisfied a high annual deductible. Typically, you will pay much lower premiums with an HDHP than you would with a traditional health plan such as an HMO orPPO.

If HSA withdrawals are not used to pay qualified medical expenses, they are subject to ordinary income tax and a 20 percent penalty. When you reach age 65, you can withdraw money from your HSA for any purpose; such a withdrawal would be subject to income tax if not used for qualified medical expenses, but not the 20 percent penalty.

What’s changed for 2024?

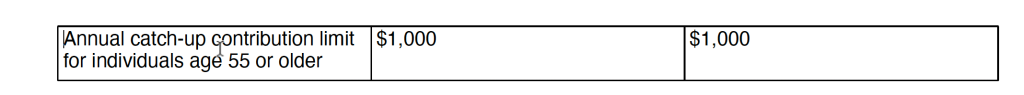

Here are the updated key tax numbers relating to HSAs for 2023 and 2024.

Disclosures:

The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented has been derived from sources Ballast Advisors considers to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing contained herein is an offer to purchase or sell any product. This material is for informational purposes only and should not be construed as tax advice. You should always consult with your tax professional with regard to specific tax questions and obligations. Ballast Advisors reserve the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request.