As the world of health insurance evolves, the Annual Enrollment Period can be overwhelming and confusing. For those nearing age 65, it’s essential to understand the paths in and around Medicare regarding your financial plan. As a full-service financial planning firm, Ballast Advisors works closely with seasoned professionals in many areas of personal financial planning, like health insurance. Recently we caught up with the owner of Hometown MN Insurance Brokerage LLC, Jill Hephzibah Truth, to get seven tips to better navigate Medicare.

Learn the A, B, and IEPs of Medicare lingo.

Medicare was established as part of the Social Security Act of 1965, and is primarily designed for individuals aged 65 and older. Medicare helps ensure older individuals can receive essential medical services and treatments. Here are some terms to know:

Medicare Part A is the component of Medicare that provides coverage for inpatient hospital care, skilled nursing facility care, hospice care, and some home health services for eligible beneficiaries.

Medicare Part B is the segment of Medicare that covers outpatient medical services, preventive care, doctor’s visits, diagnostic tests, and durable medical equipment for eligible beneficiaries.

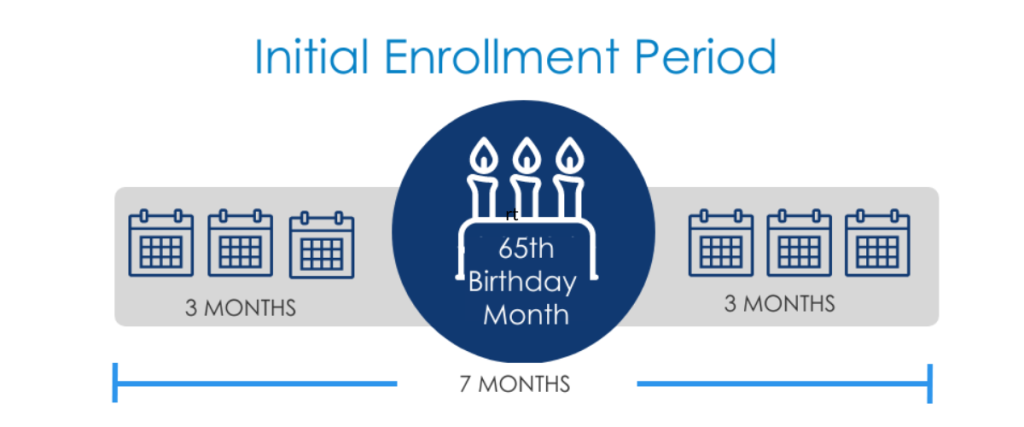

Medicare Initial Enrollment Period (IEP) is the seven-month period that begins three months before an individual’s 65th birthday month and extends for three months after their birthday month, during which they can enroll in Medicare Part A and or Part B.

Medicare Supplements, also known as Medigap plans, are private insurance policies designed to fill in the gaps in coverage left by Medicare Part A and Part B, helping beneficiaries pay for out-of-pocket healthcare expenses such as deductibles, co-payments, and co-insurance.

Medicare Advantage plans, often called Part C, are comprehensive health insurance plans offered by private insurance companies that combine the benefits of Medicare Part A, Part B, and usually Part D (prescription drug coverage) into a single managed care plan.

Medicare Part D plans are prescription drug coverage plans offered by private insurance companies that help Medicare beneficiaries afford the cost of their medications.

You have choices.

One of the most important things to remember as you approach eligibility for Medicare at age 65 is that you have choices. It’s a common misconception that you are obligated to enroll in Medicare. Jill explains that this decision cannot be made with a one-size-fits-all approach.

“If you’re currently covered by an employer plan with more than 20 employees when you turn 65, you can continue with that plan,” she explains. “However, it’s essential to consider the risks associated with this plan and your ability to manage them.”

Managing the risks associated with any healthcare plan involves understanding the premium and maximum out-of-pocket expenses. Co-pays and other costs can add up quickly, and once you reach your maximum out-of-pocket threshold, the plan will cover 100% of all approved medical charges for the rest of the year.

“Knowing whether you can manage the risks associated with reaching your maximum out-of-pocket expenses is vital. Additionally, you can choose between a plan with a low or zero premium and a high maximum out-of-pocket or a plan with a higher premium and a lower maximum out-of-pocket. Working with a broker can help you navigate these choices and choose the best plan for your unique needs,” Jill adds.

BONUS TIP: Once you go to any part of Medicare, you can no longer contribute to an HSA. You can still use the funds from your HSA for medical payments, but you can no longer contribute to it.

Mark your calendar for key deadlines.

If you are turning 65 and already receiving your Social Security benefit you will automatically be enrolled in Medicare Part A and B. If not, you have a seven-month window around your birthday to decide whether to enroll in Medicare.

Jill cautions that if you choose not to enroll in Part B after turning 65 and do not have employer coverage, you will face limitations on when you can add Part B later. The only opportunity to enroll in Part B is during your Initial Enrollment Period or during the Open Enrollment Period which is the first three months of each year (January, February, and March). Delaying enrollment in Part B will result in a penalty accumulating monthly.

Jill also advises to consider enrolling in a prescription drug plan (Plan D) or a Medicare Advantage Plan with prescription drug coverage to ensure comprehensive coverage and to avoid the Part D penalty.

Here’s an example. Suppose you elect to remain on an employer health plan after reaching age 65. In that case, when you retire, you have a 60-day period to enroll in Medicare. During this time, you must complete two forms: a Part B application for yourself and Request for Employment Information (form CMS-L564). The employer verification form is necessary to establish your employer coverage’s start and end date.

Ensure a smooth transition with your healthcare in retirement and avoid any penalties or coverage gaps by keeping track of these deadlines and completing the required forms promptly.

A broker can help.

You do not need a broker to sign up for Medicare (Part A and B), but a broker can be an invaluable resource in helping you determine if you need more than Medicare Parts A & B and help you understand what Medicare will pay for.

Many people opt for additional coverage through Medicare Supplements or Medicare Advantage plans to manage the risks associated with Original Medicare. The availability of these plans depends on the county where you reside. Insurance brokers can provide a complimentary analysis of costs and coverage options tailored to your needs.

Jill explains, “I often find that people initially enroll in a Medicare Advantage Plan based on their own online research, but as they start using it, they can encounter unexpected challenges, such as high prescription costs.” This is why seeking a broker’s advice may be a good step in finding the right plan for your specific needs.

It’s worth noting that brokers are guided by government regulations prohibiting them from charging for their services. Instead, they are compensated by the insurance carriers, a system put in place by the government to ensure objectivity and integrity. Rest assured that when working with a broker, you can confidently rely on their professional advice without any financial burden.

Understand your plan’s portability.

When you’re a frequent traveler, a “snowbird” who migrates south for the winter, or someone with two homes, the portability of your Medicare plan becomes a crucial consideration. As Jill explains, there’s a vital distinction to understand.

“Medicare Supplement plans offer a national network – this means you can seek medical care from any doctor in the United States who accepts Medicare,” Jill explains.

Let’s say you’re spending most of your time in sunny Arizona for nine months of the year but return to Minnesota for a few months. If you have a Medicare Supplement plan, you have the flexibility to receive medical treatment in either location. This portability can be particularly advantageous, especially if you face a health crisis far from your primary residence.

On the other hand, if you opt for a Medicare Advantage plan, there’s a different approach to consider. These plans often have a network of healthcare providers tied to a specific geographic area, such as your home state. If you encounter a medical issue while away from your home state, they would stabilize your condition locally and then recommend returning to your home state for further treatment.

It’s essential to understand these distinctions and weigh your options carefully. In some cases, Medicare Advantage plans may allow extended periods away from your home state, up to 12 months a year, depending on the carrier.

You may be able to change your plan.

It’s important to know that you can make changes to your Medicare plan during the Annual Enrollment Period. As you continue to age and your healthcare needs evolve, it may be necessary to adjust your plan. The Annual Enrollment Period occurs once a year, from October 15 through December 7.

During this period, individuals can assess their current plan and determine if they want to switch to a different one. Jill emphasizes the benefits of Medicare Advantage plans, as they can be changed from year to year.

“The Annual Enrollment Period holds great importance. It is a time to meet with your broker, review your prescriptions, discuss your doctors, and anticipate upcoming events or changes. It’s also an opportunity to re-evaluate your maximum out-of-pocket expenses and premiums. The goal is to ensure that you’re in a position where you feel comfortable and confident with your chosen plan,” Jill says.

You might need hearing aids or a wheelchair down the road or other medical issues that may require different prescription drugs or surgery. By taking advantage of the Annual Enrollment Period and working closely with a broker, you can optimize your Medicare coverage to align with your evolving healthcare needs.

Medicare does not cover long-term care.

It’s important to understand that Medicare generally does not provide coverage for long-term care. While Medicare does cover a limited stay of 100 days in a skilled nursing facility under certain conditions, it does not extend coverage for permanent long-term care needs. You should carefully consider this in your overall financial plan.

Planning for long-term care expenses should be integral to your retirement planning process. It’s essential to thoroughly explore and evaluate options for covering this potential expense. Long-term care costs can accumulate rapidly and become a significant financial burden if not prepared for in advance.

Various alternatives are available for securing coverage for long-term care, such as long-term care insurance or personal savings. You should research and discuss these options with a financial advisor or insurance professional to ensure adequate coverage to meet your potential long-term care needs.

By proactively addressing the issue of long-term care expenses in your retirement planning, you can mitigate the risk of facing a substantial financial burden in the future.

Not checking could cost you.

Taking the time to explore your healthcare options when approaching age 65 and being on an employer group plan is crucial. It is recommended to seek guidance from your financial planner as well as a broker to compare the employer plan to a Medicare plan. By doing so, you may discover potential savings of thousands of dollars by transitioning to Medicare.

Remember, there are no one-size-fits-all plans, and understanding the details is essential in making informed decisions about your healthcare. Don’t underestimate the importance of checking and comparing; it could significantly impact your financial standing and access to the care you need.

As a full-service financial planning firm, Ballast Advisors works closely with seasoned professionals in many areas of financial planning. For more information about Medicare or other financial planning topics, contact us.

Disclosures:

Hometown MN Insurance, LLC and Ballast Advisors are not affiliated with or endorsed by the government or Federal Medicare Program.

The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented has been derived from sources Ballast Advisors considers to be reliable, but the accuracy and completeness cannot be guaranteed. This material is for informational purposes only and should not be considered investment advice. Nothing contained herein is an offer to purchase or sell any product.

Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request. BAL-23-62