2023 Year-End Tax Tips

Here are some things to consider as you weigh potential tax moves between now and the end of the year. 1. Defer income to next year Consider opportunities to defer…

Making a last-minute contribution to an IRA may help you reduce your 2021 tax bill. If you qualify, your traditional IRA contribution may be tax deductible. And if you had low to moderate income and meet eligibility requirements, you may also be able to claim the Saver’s Credit for 2021 based on your contributions to a traditional or Roth IRA. Claiming this nonrefundable tax credit may help reduce your tax bill and give you an incentive to save for retirement. For more information, visit irs.gov.

Even though tax filing season is well under way, there’s still time to make a regular IRA contribution for 2021. You have until your tax return due date (not including extensions) to contribute up to $6,000 for 2021 ($7,000 if you were age 50 or older on or before December 31, 2021). For most taxpayers, the contribution deadline for 2021 is Monday, April 18, 2022.

You can contribute to a traditional IRA, a Roth IRA, or both, as long as your total contributions don’t exceed the annual limit (or, if less, 100% of your earned income). You may also be able to contribute to an IRA for your spouse for 2021, even if your spouse didn’t have any 2021 income.

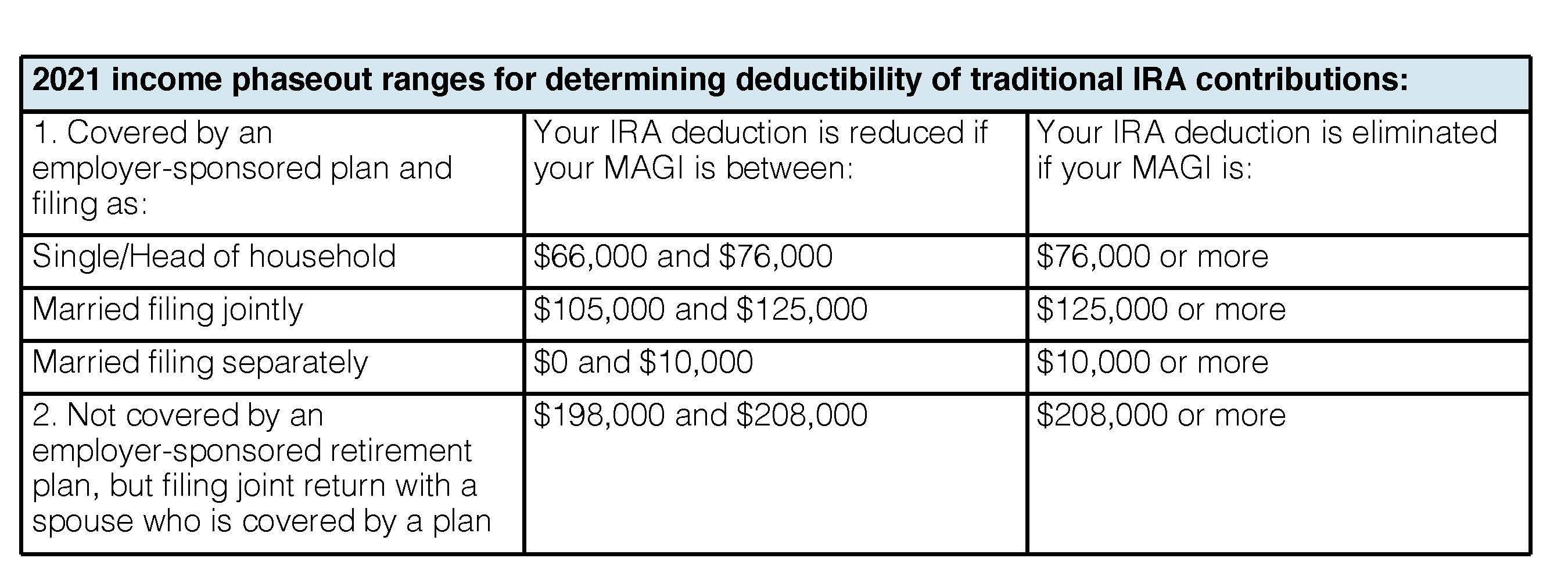

You can contribute to a traditional IRA for 2021 if you had taxable compensation. However, if you or your spouse were covered by an employer-sponsored retirement plan in 2021, then your ability to deduct your contributions may be limited or eliminated, depending on your filing status and modified adjusted gross income (MAGI). (See table below.) Even if you can’t make a deductible contribution to a traditional IRA, you can always make a nondeductible (after-tax) contribution, regardless of your income level. However, if you’re eligible to contribute to a Roth IRA, in most cases you’ll be better off making nondeductible contributions to a Roth, rather than making them to a traditional IRA.

You have until your tax return due date (not including extensions) to contribute up to $6,000 for 2021 ($7,000 if you were age 50 or older on December 31, 2021) to all IRAs combined. For most taxpayers, the contribution deadline for 2021 is April 18, 2022.

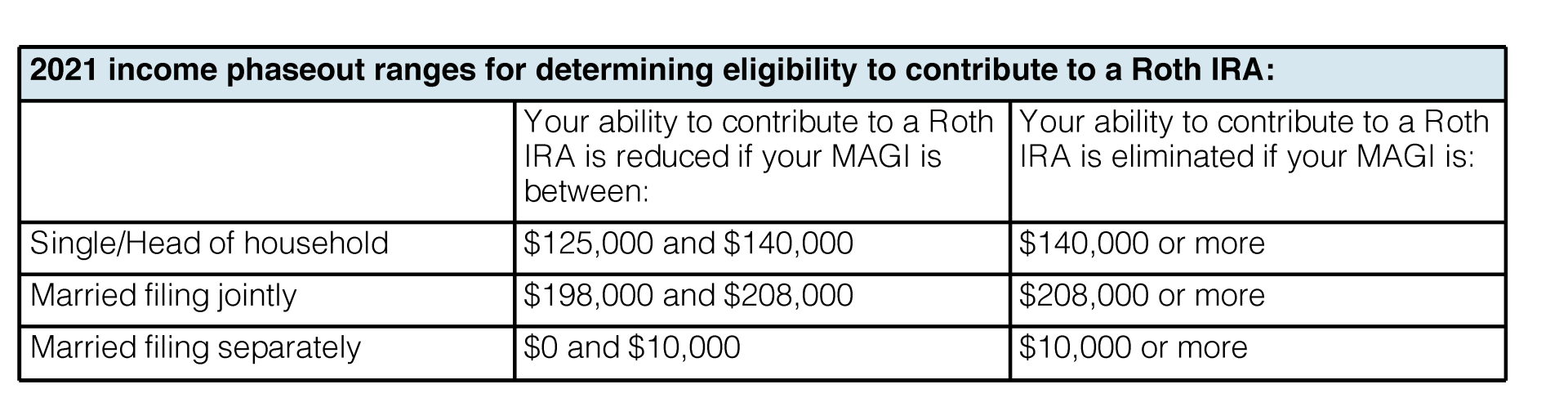

You can contribute to a Roth IRA if your MAGI is within certain limits. For 2021, if you file your federal tax return as single or head of household, you can make a full Roth contribution if your income is $125,000 or less. Your maximum contribution is phased out if your income is between $125,000 and $140,000, and you can’t contribute at all if your income is $140,000 or more. Similarly, if you’re married and file a joint federal tax return, you can make a full Roth contribution if your income is $198,000 or less. Your contribution is phased out if your income is between $198,000 and $208,000, and you can’t contribute at all if your income is $208,000 or more. If you’re married filing separately, your contribution phases out with any income over $0, and you can’t contribute at all if your income is $10,000 or more.

Even if you can’t make an annual contribution to a Roth IRA because of the income limits, there’s an easy workaround. You can make a nondeductible contribution to a traditional IRA and then immediately convert that traditional IRA to a Roth IRA. Keep in mind, however, that you’ll need to aggregate all traditional IRAs and SEP/SIMPLE IRAs you own — other than IRAs you’ve inherited — when you calculate the taxable portion of your conversion. (This is sometimes called a “back-door” Roth IRA.) If you make a contribution — no matter how small — to a Roth IRA for 2021 by your tax return due date and it is your first Roth IRA contribution, your five-year holding period for taking qualified tax-free distributions

from all your Roth IRAs (other than inherited accounts) will start on January 1, 2021.

IMPORTANT DISCLOSURES The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented is derived from sources Ballast Advisors consider to be reliable, but the accuracy and completeness cannot be guaranteed. Past performance is not indicative of future results. Nothing contained herein is an offer to purchase or sell any product. This material is for informational purposes only and should not be considered investment advice. Ballast Advisors reserve the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request.

Here are some things to consider as you weigh potential tax moves between now and the end of the year. 1. Defer income to next year Consider opportunities to defer…

Hello there! As we bid adieu to this year, it’s a golden opportunity for savvy investors and retirement planners to give their strategies a once-over, particularly when it comes to…

Dive into our latest blog for a better understanding of the ever-shifting market sentiment in Ballast Advisor’s third-quarter update. Bullish optimism may be fading, but we’re here to equip you…

As the leaves turn golden and the air grows crisp, we can’t help but look forward to heartwarming holidays, joyous parties, and reunions with our loved ones. But before we…

The IRS has announced guidance for the home energy audit tax credit. When considering making energy-saving home improvements, it may be helpful to have a home energy audit done. Fortunately,…

As the world of health insurance evolves, the Annual Enrollment Period can be overwhelming and confusing. For those nearing age 65, it’s essential to understand the paths in and around…

2023 survey revealed a notable shift in public opinion over the past decade about the value of a college degree: 56% of Americans think a four-year college degree isn’t worth…

The IRS recently released the 2024 contribution limits for health savings accounts (HSAs), as well as the 2024 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs). What…

Yes, there are good things about being old, such as increased happiness, less stress, better marriages and deeper friendships. You seldom hear that: People tend to focus on the negatives…

The home mortgage is often the biggest transaction of a person’s life. In today’s dynamic economic landscape, mortgage interest rates play a significant role in shaping individuals’ financial plans. Whether…